On May 14, 2024, US President Joe Biden announced significant tariff increases on several Chinese imports. This policy was issued in the context of trade tensions between the US and China continuing to increase, with the goal of protecting US industries from unfair competition.

US tariff increase policy on Chinese imports:

On May 22, 2024, the Office of the United State Trade Representative (USTR) issued a federal notice proposing a number of tariff modifications on Chinese imports to be implemented from August 1, 2024. This includes strategic and key industries such as electric vehicles (EVs), solar panels, semiconductors, steel and aluminum products. The new tariff increase will affect USD18 billion worth of Chinese imports, specifically:

| Category | Tariff | Date |

| Battery parts | Increase from 7.5% to 25% | August 1, 2024 |

| Electric vehicles (EV) | Increase from 25% to 100% | August 1, 2024 |

| Lithium-ion EV batteries | Increase from 7.5% to 25% | August 1, 2024 |

| Lithium-ion non-EV batteries | Increase from 7.5% to 25% | January 1, 2026 |

| Permanent magnets | Increase from 0% to 25% | January 1, 2026 |

| Semiconductors | Increase from 25% to 50% | January 1, 2025 |

| Solar cells (whether or not assembled into modules) | Increase from 25% to 50% | August 1, 2024 |

| Steel and aluminum products | Increase from 0 – 7.5% to 25% | August 1, 2024 |

| Natural graphite | Increase from 0% to 25% | January 1, 2026 |

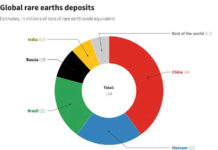

| Other critical minerals | Increase from 0% to 25% | August 1, 2024 |

| Ship-to-shore cranes | Increase from 0% to 25% | August 1, 2024 |

| Facemasks | Increase from 0 – 7.5% to 25% | August 1, 2024 |

| Syringes and needles | Increase from 0% to 50% | August 1, 2024 |

| Medical gloves | Increase from 0 – 7.5% to 25% | January 1, 2026 |

The US has imposed additional tariffs under Section 301 of the Trade Act of 1974 on these products. The White House said the decision was made due to “unacceptable risks” to US economic security because of what the country considers “China’s unfair behavior”.

The statutory review of the Section 301 has found that they are “effective in encouraging China to take steps toward eliminating some of its technology transfer-related acts, policies, and practices” while reducing exposure to US individuals and businesses to these actions. Accordingly, tariffs have had little negative impact on the US economy, while they have positively impacted production in the 10 sectors most directly affected by tariffs. However, USTR also believes that “further action” is needed because China continues to impose policies related to technology transfer.

China’s countermeasures:

Following the US announcement on tariffs, China’s Ministry of Commerce (MOFCOM) announced that China would take “resolute measures to protect its rights and interests”. MOFCOM stated that the US decision to increase tariffs violates President Joe Biden’s commitment of “not seeking to contain China’s economic development” and “not seeking to decouple from China”, and is not in line with the consensus reached by the two heads of state and “will seriously affect the bilateral cooperation”.

In fact, China has already imposed countermeasures against US actions. On May 19, 2024, MOFCOM announced an anti-dumping investigation into imported polyformaldehyde (POM) copolymers originating in the EU, the US, Taiwan, and Japan. The probe, which is seen as an attempt to deter further US and EU actions, could result in anti-dumping tariffs on these goods.

US-China trade tensions:

The tariff increases on Chinese imports are likely to exacerbate the economic divide between the US and China, potentially igniting a second trade war. However, China has taken a more cautious approach to its countermeasures, avoiding direct retaliation. This restraint suggests the two countries can avoid a repeat of the trade tensions of 2018, as they sought to avoid the economic consequences experienced during the previous conflict.

In certain sectors, the new tariffs and countermeasures will result in higher production costs and disrupted supply chains. US companies that rely on Chinese imports for critical components will face increased costs, which could be passed on to consumers. In contrast, Chinese exporters will find their competitiveness in the US market significantly reduced, leading to potential revenue losses and the need to explore alternative markets.

The tariffs may also accelerate trends in global supply chains, such as re-shoring, near-shoring, and diversification. US companies might seek to bring manufacturing back to the US or seek alternative suppliers from other countries to mitigate future tariff risks. Similarly, Chinese companies may seek to circumvent the tariffs by setting up manufacturing operations in third countries or even starting domestic production within the US. These actions, however, could prompt the US to issue further preventative measures to close such loopholes.

Impact on Vietnam:

Developing economies such as Brazil, India, South Africa, Vietnam,… will face pressure on cheap imports from China, which could cause significant damage to domestic manufacturers. As a result, trading chaos and a slowdown in global growth are likely to occur in the near future.

In the past, Vietnam was investigated by the US for allowing Korea to disguisely produce steel in Vietnam and then sell it to the US, or China also disguisedly produced aluminum and steel in Vietnam and then exported it to the US. Therefore, Vietnam needs to reduce its dependence on raw materials from China as well as take measures to prevent the disguised production of Chinese goods and then export them to the US.

On the other hand, if Vietnam fails to prevent cheap Chinese imports, it will become increasingly difficult for Vietnamese manufacturers. Therefore, Vietnam needs to take measures to respond to this problem.

References:

- Arendse Huld, 2024, US Tariff Increases on Chinese Imports – Implications for Trade and Businesses, China Briefing, available at: https://www.china-briefing.com/news/us-tariff-increases-on-chinese-imports-implications-for-trade-and-businesses/.

- TS. Bùi Ngọc Sơn, 2024, Mỹ tăng thuế với Trung Quốc (Kỳ II): Những tác động khó lường, Tạp chí Diễn đàn doanh nghiệp, available at: https://diendandoanhnghiep.vn/my-tang-thue-voi-trung-quoc-ky-ii-nhung-tac-dong-kho-luong-263978.html.

- Office of the United States Trade Representative, U.S. Trade Representative Katherine Tai to Take Further Action on China Tariffs After Releasing Statutory Four-Year Review, available at: https://ustr.gov/about-us/policy-offices/press-office/press-releases/2024/may/us-trade-representative-katherine-tai-take-further-action-china-tariffs-after-releasing-statutory .

- Ministry of Commerce of China, available at: http://us.mofcom.gov.cn/article/jmxw/202405/20240503509953.shtml.